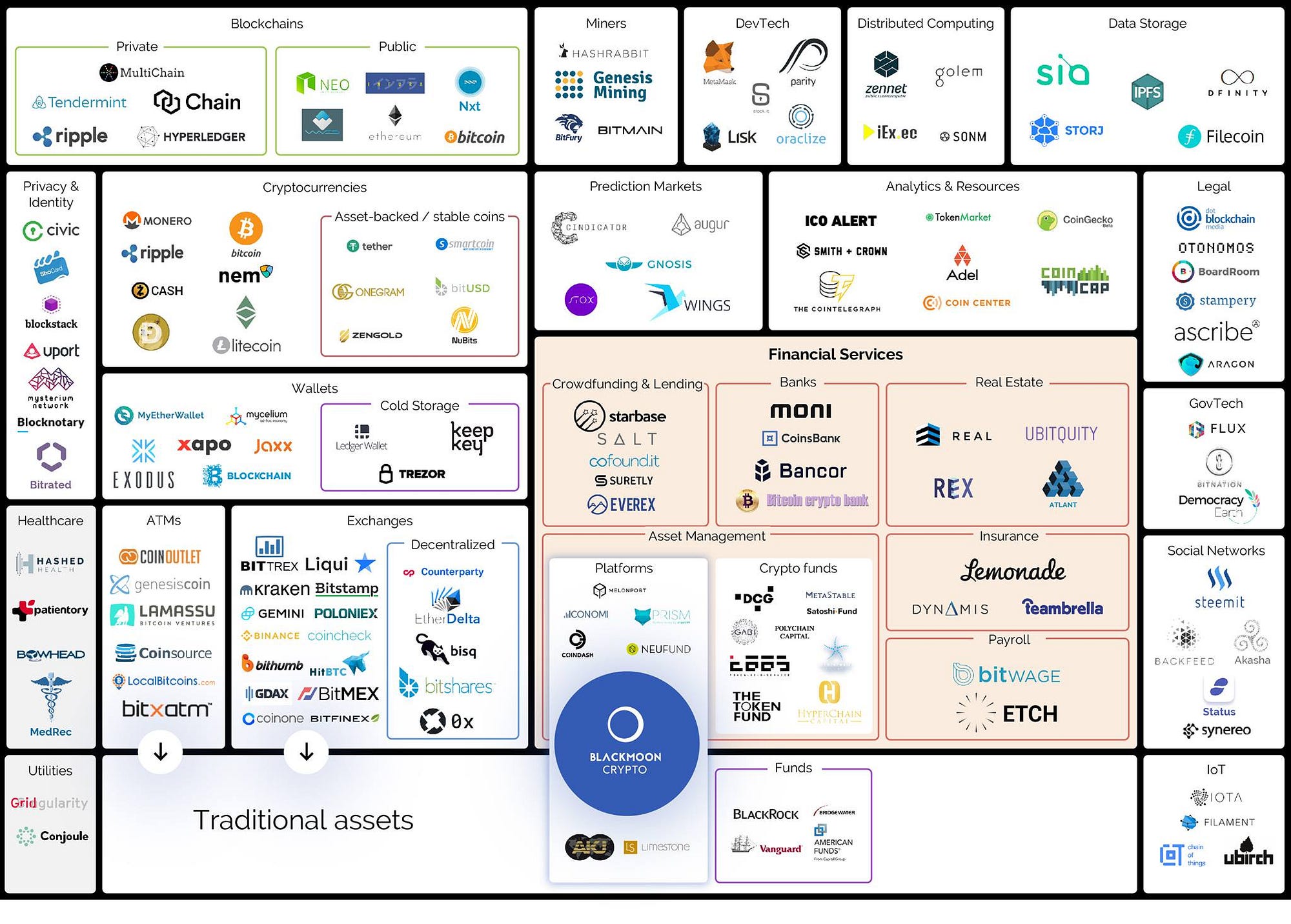

암호화폐 생태계 지도 - https://news.blackmooncrypto.com/the-crypto-ecosystem-v2-aea76bde5457

The Crypto Ecosystem, v2

After a huge success of our article The Crypto Finance Ecosystem, that got more than 7.7k views on Medium alone, it became our duty to update it once in a while. Let’s get ready to a deeper dive into Crypto Ecosystem. As always, your comments are more than welcome.

We will start with the finance ecosystem and then proceed to other sectors.

Financial Services

Asset Management

With the proliferation of trade and the increasing amount of wealth stored in cryptocurrencies, asset management services have emerged to take advantage of the functionality of smart contracts. This industry is divided into two parts: platforms that allow users to create and manage funds (or participate in other’s funds) and professionally-managed crypto funds. Most of these services manage funds only inside the crypto universe.

On the side of the traditional financial world there are also many investment vehicles, offering the wide range of investment opportunities. For instance, Vanguard, one of the biggest investment management companies, that provides investors with various mutual and exchange-traded funds or Limestone, a platform that allows asset managers to use the established fund umbrellas and provide managers with the relevant assistance and services. None of them use blockchain yet.

Blackmoon Crypto combines the best of the both worlds. For investors, we are developing a platform where you can invest in different professionally-managed funds that are transparent and legally compliant. For asset managers, we provide the IT and legal infrastructure they need to set up their own tokenized investment vehicles.

The Blackmoon Crypto platform not only combines the best asset management tools inside the crypto universe, but also brings the best fiat solutions and gives everybody an opportunity to participate.

Crowdfunding and Lending

Blockchain technology disrupts the field of lending and crowdfunding. One of the companies that belongs to this category is SALT. Blockchain allows this company to streamline the loan processing and accept cryptocurrencies as a collateral. Crowdfunding sector is overwhelmed with blockchain companies that in the near future can merge venture capital companies, there is a wide range of companies, we listed some of them- Cofound.it and Starbase.

Banks

The banking industry was also affected by blockchain. In this category we included crypto banks which provide a wide range of services related to the cryptocurrency. CoinsBank — one of the segments most famous representatives — provides its clients with access to crypto wallets (to manage their funds when and where they want), debit cards (real-time cryptocurrencies conversions), merchants (payment options) and exchanges (to earn by trading).

Real Estate

The real estate sector is quite resistant to new technologies, but even this sector is changing under the pressure of blockchain, blockchain allows to lower the costs, provide transparency to the records and transactions and reduce frauds. One of the brightest examples of real estate companies successfully applying blockchain technology to their business is REX that connects buyers and sellers of the real estate.

Insurance

Blockchain can significantly change the insurance sector with new companies based on blockchain technology. Peer-to-peer insurance could require significant changes into the whole insurance market, for example Teambrella, a platform that allows coverage for any situation without need to address to trusted agents or Dynamis that provides customers with supplementary unemployment insurance.

Payroll

There are not so many companies that implemented blockchain in the payroll system. One of the companies that represents this category, is Bitwage. This startup allows companies to accelerate the process of wage payments to remote employees and reduce payroll costs.

Blockchains

Blockchain is a foundation of the blockchain economy. All the projects and companies in the crypto-world are based on this innovation. There are public and private protocols. The sole distinction between these blockchains is the accessibility of members to participate in the blockchain network. Public blockchains are open for all members, while private blockchain networks require an invitation or permission to join. Hyperledger Fabric is one of the examples of the private blockchain network that allows individuals to participate on their blockchain only after their permission.

Miners

Mining sector works in the background to add new transactions to the distributed ledger in the blockchain and secure the global record of all transactions. There is a high density of mining facilities in China and one of the most biggest bitcoin mining pools is AntPool, which belongs to the chinese company Bitmain.

DevTech

This category entails companies that created developer frameworks that help ease the way of running decentralized applications. Some companies as MetaMask allows clients to visit the distributed web without running a full Ethereum node, others as Oraclize act as an intermediary between the external data and decentralized applications. One thing is certain: with the help of these technologies and the companies that create them, blockchain companies can focus on their product.

Distributed computing

This segment includes services that enable you to use the unused computing power of other users to solve the most intensive calculations and companies that offer to use their supercomputers. For instance, SONM offers the fog supercomputer that is designed to deal with the large amounts of data and other tasks that require computing power.

Data Storage

Services that store your data on the blockchain based clouds or allow you to rent the unused data capacity to other users of the network. Moreover, IPFS for example, also provides users with an opportunity to show that the file, stored in their system, belongs specifically to you, by tagging documents with special human-readable names.

Privacy and Identity

Digital wallets store your digital and physical credentials and then allow you to use them as an authenticator whenever you need it. Some companies like Mysterium help to rent the unused traffic and receive tokens in turn. Overall, both directions try to keep your data private and make your digital track less fragile. Shocard and Civic serve as an example of companies that help to verify the user’s identification.

Cryptocurrencies

Today there are hundreds of cryptocurrencies that are traded on the exchanges. Some of them have their own blockchain networks, such as Ethereum and Zcash; others cannot boast of their blockchain innovations such as Dogecoin and Litecoin. We identified stable coins and asset-backed coins as a separate group, these digital currencies are back uped by fiat currencies or precious metals. In contrast to ordinary cryptocurrencies, these coins have a lower level of volatility. There are some stable coins as NuBits and Tether and asset-backed coins as Zengold and BitUSD.

Wallets

A category which includes wallets is no less important than other sectors, wallets provide investors with an opportunity to securely store, send and receive cryptocurrencies. Thanks to this necessary application, every crypto investor can easily check the balance and execute any cryptocurrency transactions. Wallets can be divided into two groups: hot and cold wallets; the main difference between them is a direct connection of the wallet to the internet. Cold wallets are used for offline storage of cryptocurrencies, hence, they are more protected from hacker’s attacks. Trezor can serve as an example of a cold wallet, which supports many of cryptocurrencies, including Bitcoin, Dash, Ethereum, Litecoin and others.

ATMs

ATMs are machines that allow a person to exchange crypto- and fiat currencies. A minority part of ATMs has a bi-directional functionality which means that it is possible not only buy, but also sell cryptocurrencies through the machine. Apart from traditional ATMs, crypto-ATMs has no connection to the bank account. Instead, they are directly connected to the crypto-exchanges. The world’s largest operator is Coinsource, the number of machines outnumbered 120 units in total by the end of July.

Exchanges

The exchange sector is considered to be one of the largest industries in the crypto world. Exchanges allow investors to buy and sell cryptocurrencies and crypto assets for fiat currencies and other currencies. Exchanges play an essential role in the cryptocurrency economy, we divided them into two groups- centralized and decentralized exchanges. A distinct difference between these types of exchanges is the presence of the third party service where the investment vehicle holds the customer’s funds.

Prediction markets

Decentralized prediction markets allow users to gain material profit in the form of tokens in exchange for their correct predictions of the events’ outcome, such as the president elections or the token sale. There is a wide range of markets that have this business model, for example Stox, Augur and Gnosis.

Analytics and resources

These resources and web sites provide the blockchain community with the relevant information and data that is necessary for the investors to execute their investment strategy or for the companies that are newbies in the crypto world and need promotion among the crypto community. There are lots of resources that help not to drown in the excess of the information, one of the most popular are Smith and Crown and Cointelegraph.

Legal

Companies attributable to this sector solve the bureaucracy problems. For example, BoardRoom addresses the problem of the dApp’ management on the permissioned blockchain networks by offering ready decisions for the proxy voting or the legal compliance of the organization, based on the blockchain, to the existed regulatory rules.

GovTech

The companies, located in this sector want to build and improve online governance tools as the distributed voting system or identification of documentation. Such companies as Democracy Earth and Flux are coping with the problems of the inefficacy and intransparency of the democratic system.

Social Networks

Social media also suffers major change due to the rise of the blockchain. Besides the blockchain based structure of the social websites, there is also a system of the content’ monetizing that is successfully implemented in such projects, as Steem and Synereo.

IoT (Internet of Things)

Blockchain enables devices to hold unique identities on a public ledger and transfer information between all the gadgets, thus allowing a customer to connect all the devices. Such companies as Ubirch and Filament set these objectives, besides that they are concerned about the security of all the data, stored on these gadgets (“things”).

Healthcare

Blockchain also did not neglect the healthcare industry, the majority of startups in this sphere helps to record medical information on patients in a cryptographic database that is available to anyone. MedRec and Patientory are the companies that improve the accessibility of the health information to the users.

Utilities

Blockchain also grabbed the attention of the utilities industry, besides the heavy regulation that is traditional to this sphere, startups allow users to share the surplus of their electricity or solar energy to their neighbours or to monitor the performance and condition of the grid equipment. The next companies: GridSingularity and Conjoule offer these services to their consumers, thus providing users with more financial and operational efficacy and low-cost opportunities.